Markets are volatile, stay true to your long term philosophy.

In light of the recent COVID19 “pandemic” that the World Health Organisation issued, the financial system seems to have gone into melt down.

Portfolios around the world are showing substantial losses (on paper) and the panic and fear from the general population seem to have the Dooms Day Preppers citing the words “we told you so” whilst stocking up on the standard toilet paper and essentials to bunker down ready for the world to end. Is this typical behaviour? Absolutely not, but we are aware that the health and safety of people is paramount in these situations so we certainly understand the anxiety.

With something like what we are experiencing at the moment, the tendency is to sell off to defensive assets to curtail portfolios dropping further. After approximately a 20% decline over the last few weeks, are we already at the bottom? Or is there more fear to come that impacts the markets to drop even further? These questions can only be answered by the market and absolutely no one can consistently pick the bottom and top of every market cycle.

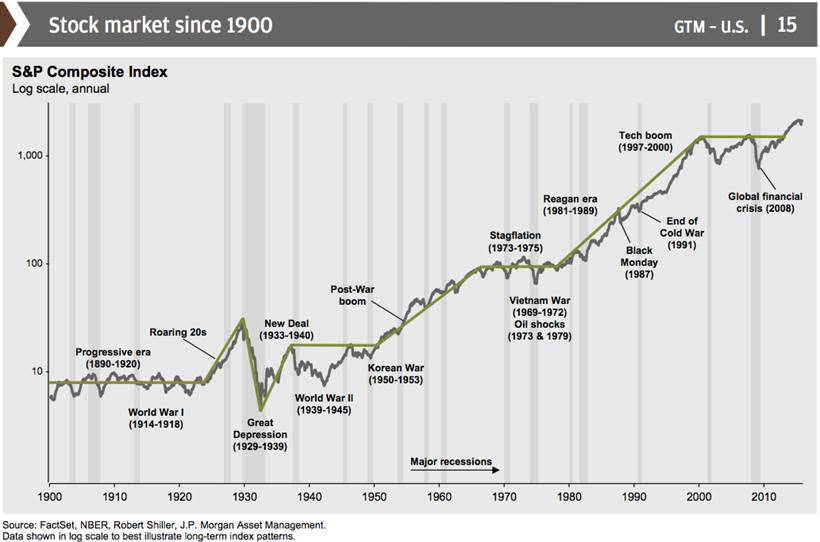

So with this information, our best course of action is referring to history. What has happened in times where markets dropped on the back of negative sentiment? The GFC, the Tech Boom & Bust, 1987 Stock Market crash (Black Monday) all events throughout history that impacted financial markets negatively. But there seems to be one constant. At some point in time in the future, the market rose above the point where the down turn began. And although we cant say with absolute surety this will happen, 100 years of stock market data suggest that this is a bump in the road.

So with this, we understand the fear of the investor. The fear of losing more money, the fear of not having the income to spend on the lifestyle items. We maintain our philosophy has always remained the same. Long term investing on the market has generally provided the goals and objectives of a client after a period of time. To reiterate our point, below is a chart from JP Morgan Asset Management showing the S&P Composite Index dating back to approx. 1900. The volatility has always been there and the recovery follows soon after.

We believe this is a correction no different to ones in the past, and those who don’t need to sell and have time on their side, are best served by avoiding all news outlets, refraining from logging in to portfolio sites and enjoying time with family and friends to focus on the issues we can control as opposed to the ones we can't.